Best 1-on-1 Econometrics tutors for Columbia, NYU, Yale, Princeton, Brown.

Available in-person and online in New York. Our econometrics tutors are experts in topics such as classical linear regression model, multiple regression, Gauss Markov assumptions, dummy variables, fixed effects, random effects, instrumental variables, logit and probit models.

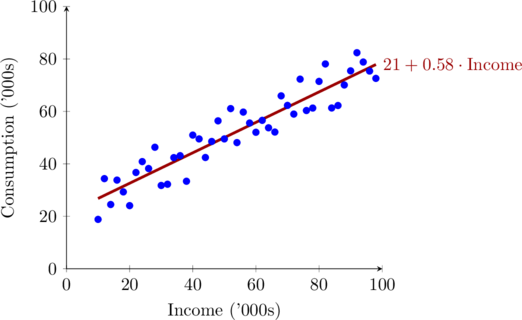

The linear regression model is given by ![]()

is the dependent variable,

is the dependent variable, is the independent variable,

is the independent variable, is the intercept,

is the intercept, is the slope,

is the slope, is the error term

is the error term is the sample size

is the sample size

The resulting estimators for ![]() and

and ![]() , denoted by

, denoted by ![]() and

and ![]() are derived using the OLS technique.

are derived using the OLS technique.

OLS predicted values ![]()

Question: what is the difference between ![]() and

and ![]()

R-Squared is the ratio of ESS to TSS

R-squared explains the proportion of variation in data explained by the model. Higher R-squared implies that our model is able to explain a higher proportion of variation in the dependent variable.

Columbia University Econometrics Tutors Lecture 1

Columbia University Econometrics Tutors Lecture 2

New York Econometrics Tutors online Lecture 3

PhD Tutor Econometrics Lecture 4

Book a free trial lesson with our econometrics tutor for Columbia University in New York, NY.